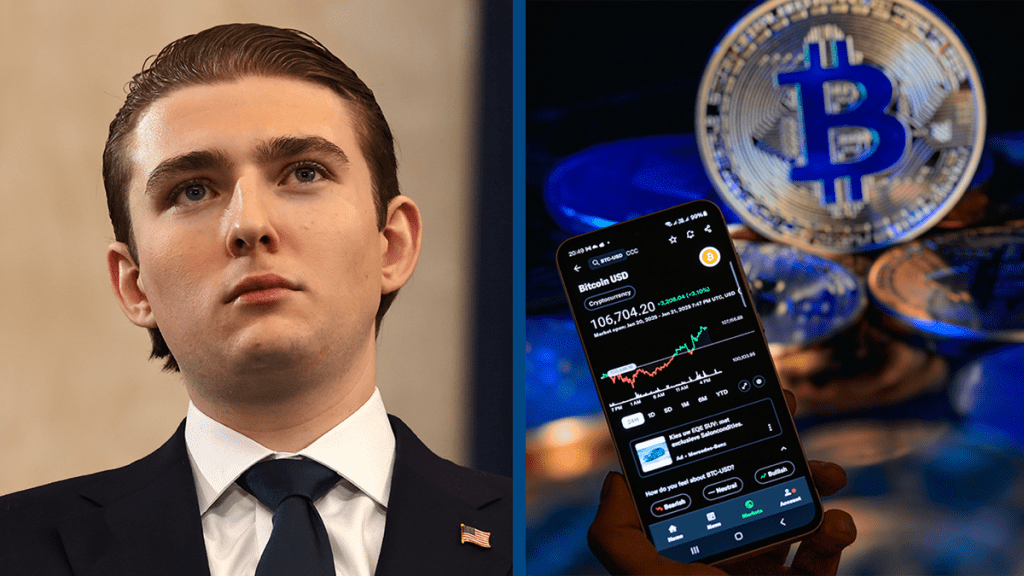

Cryptocurrency markets have been incredibly volatile, but one trader’s misfortune highlights the risks of investing in the unregulated space. After hopping on what appeared to be a promising opportunity, the trader ended up losing close to $1 million in just two hours when they mistakenly invested in a fake coin called $BARRON, which was purportedly associated with Barron Trump, the youngest son of former President Donald Trump.

Cryptocurrencies have been riding a high since Trump’s election victory, with Bitcoin reaching new all-time highs and other “meme coins” like Dogecoin gaining widespread attention, especially after Elon Musk’s involvement. The market has attracted both seasoned investors and newcomers, and while many have profited, there have been plenty of scams and failed projects that have left investors empty-handed.

Among the legitimate coins that have gained traction, $TRUMP, a cryptocurrency tied to the former president, has seen massive success. With over 500 people becoming millionaires in a 24-hour span, it created huge excitement in the market, only to be followed by Melania Trump’s own meme coin. While these coins have enjoyed success, they have also paved the way for imitators hoping to capitalize on the hype.

The $BARRON coin was one such imitator, and many mistakenly believed it had ties to Barron Trump. This led to a surge in investment, but like many pump-and-dump schemes, once the coin’s value spiked, its creators sold off their holdings, causing the price to plummet. Within a mere two hours, investors, including one trader who lost almost $1 million, saw the value of their investments vanish.

This kind of scheme is unfortunately common in the crypto world, where the lack of regulation leaves traders vulnerable to manipulation. Pump-and-dump tactics, where the price is artificially inflated only to be dumped by creators for a profit, are a known risk. The rapid rise and fall of the $BARRON coin were a perfect example of this unethical practice.

While some have expressed sympathy for the trader who lost such a substantial amount, others have pointed out how easy it is to fall victim to the fear of missing out (FOMO) in the high-stakes crypto market. “FOMO is one helluva drug,” one social media user commented, reflecting on how powerful the urge to catch the next big wave can be, especially when the market is heavily influenced by figures like Donald Trump.

This incident serves as a stark reminder to exercise caution in the crypto world, where the potential for both massive gains and equally massive losses exists, often due to little more than hype and speculation.